Table of Contents

- Earned Income Tax Credit Schedule 2024, Eligibility, Amount and How to ...

- Income Tax Return AY 2024-25: ITR-1, ITR-2, ITR-4 Enabled for Online ...

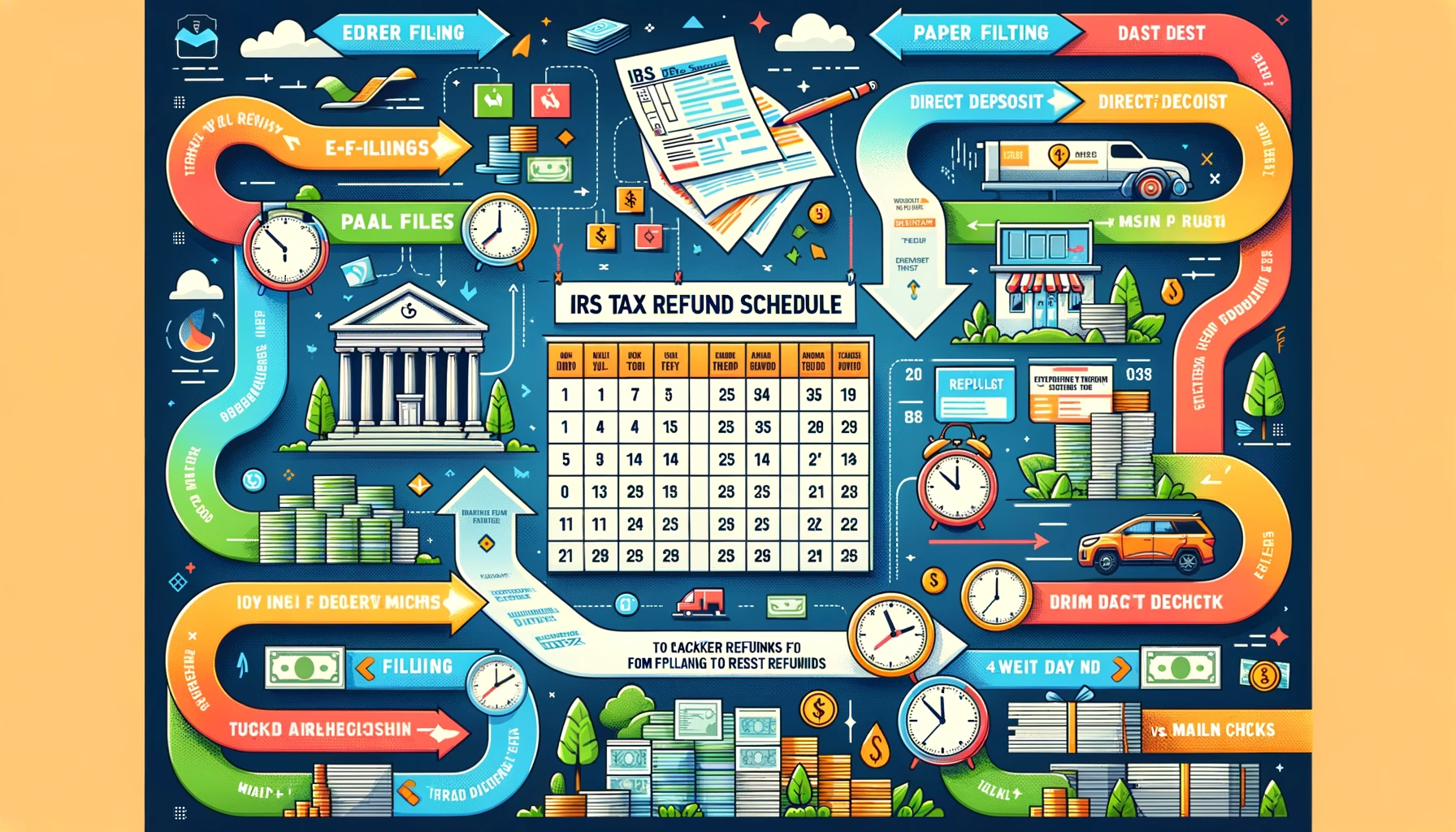

- 2024 Average IRS and State Tax Refund Processing Times - TuKAK.com

- Taxes 2024: IRS tax deadline is April 15 to file a tax return or extension

- TODAY is D Day: 2024 tax return deadline

- IRS Tax Return 2024: Why Tax Returns May Be late & Should You Wait For ...

- IRS 2024 Tax Season Start Date for US Expats

- 2024 Average IRS and State Tax Refund Processing Times - TuKAK.com

- IRS Announces 2024 Tax Filing Season Will Open On January 29

- IRS Plans to Ramp Up Collections and Tax Audits in 2024

What are the E-Filing Start and Stop Dates for Federal Returns?

Key Dates to Keep in Mind

How Intuit Accountants Can Support Your E-Filing Needs

Intuit Accountants offers a range of tools and resources to support your e-filing needs, including: Tax Preparation Software: Intuit's tax preparation software, such as Lacerte and ProSeries, provides a comprehensive platform for preparing and e-filing federal returns. E-Filing Support: Intuit Accountants offers dedicated e-filing support, including troubleshooting and assistance with resolving e-filing errors. IRS-Approved E-Filing: Intuit Accountants is an IRS-approved e-file provider, ensuring that your e-filed returns are submitted securely and efficiently.

Benefits of E-Filing with Intuit Accountants

E-filing with Intuit Accountants offers a range of benefits, including: Faster Refunds: E-filing can result in faster refunds, as the IRS can process e-filed returns more quickly than paper returns. Increased Accuracy: E-filing reduces the risk of errors, as the software checks for mistakes and inconsistencies before submitting the return. Improved Security: Intuit Accountants' e-filing platform ensures that your clients' sensitive information is protected with robust security measures. In conclusion, understanding the e-filing start and stop dates for federal returns is crucial for accounting professionals. By staying informed and leveraging the tools and resources offered by Intuit Accountants, you can ensure a smooth and efficient e-filing process for your clients. With Intuit Accountants, you can trust that your e-filed returns are submitted securely and accurately, resulting in faster refunds and improved client satisfaction.For more information on e-filing start and stop dates and how Intuit Accountants can support your e-filing needs, visit the Intuit Accountants website or check the IRS website for the latest updates.